Labour Market Report – October 2024

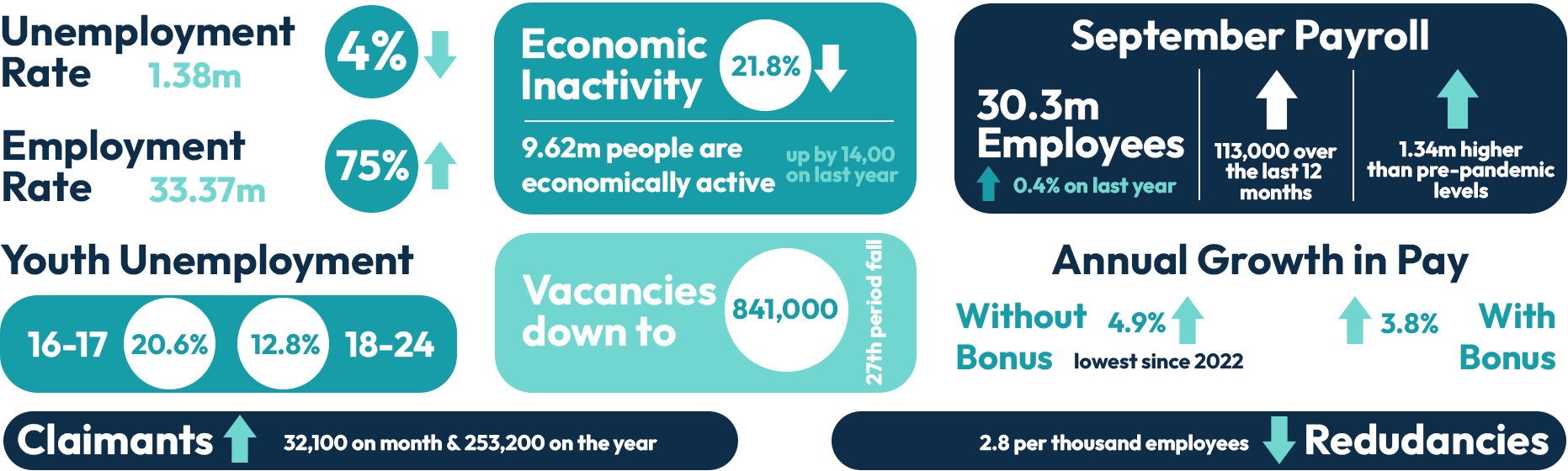

The latest ONS Labour Market Overview shows that:

The British Chamber of Commerce Quarterly Recruitment Outlook found that fewer firms were recruiting. Key findings include:

The London School of Economics (LSE) latest research on Why do flexible working arrangements exist? found workers on zero-hour contracts (ZHC) face lower wages and significantly higher turnover rates, yet such jobs have 25 per cent more applicants than a permanent position for the same role. In addition, it found ZHC staff typically stay in their job for only a third as long as the same staff on fixed-hour contracts. From an employer’s perspective, ZHCs serve as an essential tool for managing staffing and demand fluctuations.

The Institute for Employment Studies (IES) Future of Employment Support reports a major contraction in the UK labour force, driven primarily by fewer people entering the workforce rather than more people leaving. The IES suggests that better support for people returning to work is crucial for addressing this.

HR Review reports on a recent survey by HR software provider Ciphr revealing that 26% of UK employees are seeking new job opportunities this year, driven by cost-of-living challenges, with young people being the most motivated to change jobs.

The Resolution Foundation’s Labour Market Outlook Q3 2024 report highlights the government’s plan to replace the Apprenticeship Levy with the more flexible Growth and Skills Levy, aimed at making training more accessible for businesses to help develop skills with in the workforce.

KPMG and REC, UK Report on Jobs: North of England reports that the number of staff placed into permanent roles in the North of England declined in October. The rate of contraction was not only marked, but the quickest seen for four months. Recruiters in the region blamed caution surrounding the impending Autumn Budget and fewer job vacancies. However, after a brief period of decline in September, the seasonally adjusted Temporary Billings Index posted above the crucial 50.0 mark in October, to signal a rise in billings received from the employment of temp staff in the North of England.

There were only fractional increases in job vacancies for both permanent and temporary positions across the North of England in October. October survey data showed that although permanent vacancy growth was sustained for an eighth successive month, it was indeed the slowest in the sequence.

There was a further sharp rise in permanent staff availability across the North of England in October, thereby extending the current run of expansion to ten months. According to anecdotal evidence, labour supply was pushed up due to subdued hiring conditions and increased redundancies. October survey data also pointed to a sustained increase in the availability of workers for short-term roles across the North of England. As well as it being steep, the rate of expansion accelerated to the strongest for nearly four years.

The Employment Rights Bill, which is progressing through Parliament is touted as the most significant upgrade to workers’ rights in a generation and is expected to take at least a couple of years to implement fully. Consultations are already underway, addressing key issues such as extending Statutory Sick Pay and exploring how zero-hours contract provisions might apply to agency workers. The governing body for recruitment both the Recruitment & Employment Confederation (REC) and Association of Labour Providers (ALP) are consulting with the government for these changes, GEM Partnership as a member of both bodies are keeping fully up to date on the changes and happy to have any discussions on the changes proposed please contact maria.miller@gempartnership.com

October also saw Chancellor Rachel Reeves deliver labours first Budget, key takeaways for Employers are:

From April 2025, Employers National Insurance Contributions (ENIC) will rise from 13.8% to 15%, applying to salaries above £5,000 (down from £9,100). This increase is expected to raise £25 billion annually and is partially offset by the doubling of the Employment Allowance to £10,500, which will exempt some small businesses from NI.

| NMW Rate | Increase (£) | Increase (%) | |

| National Living Wage (21 and over) | £12.21 | £0.77 | 6.7 |

| 18-20 Year Old Rate | £10.00 | £1.40 | 16.3 |

| 16-17 Year Old Rate | £7.55 | £1.15 | 18 |

| Apprentice Rate | £7.55 | £1.15 | 18 |

Legislation will be introduced in a future Finance Bill to make labour providers responsible for accounting for PAYE on payments made to workers that are supplied using umbrella companies. Where there is no agency, this responsibility will fall to the end client business. This will take effect from April 2026. GEM partnership payrolls all workers directly as such, there are no concerns of this change for GEM’S clients. More information is detailed in the Tackling non-compliance in the umbrella company market policy paper which was published on 30th October.

The Government has tasked the Migration Advisory Committee (MAC) with reviewing the financial requirements of the family immigration rules. These include the Minimum Income Requirement (MIR) and adequate maintenance (AM) tests, which assess whether an individual joining or remaining with family members in the UK (for more than six months) is financially independent and won’t require public funds. The MIR is currently set at £29,000, with plans from the previous government to raise it to £34,500 by early 2025, and £38,700 later that year.

The Government has also released the latest figures on visa applications:

According to the Financial Times, immigration is driving the fastest population growth in the UK in half a century, with the population reaching 68.3 million by mid-2023, a 1% increase over 12 months. England and Wales experienced faster growth (1%) than Scotland (0.8%) and Northern Ireland (0.5%).

GEM are looking forward to working with our clients advising on all forthcoming changes initiated from the Employment Rights Bill and associated policy changes, impacting our industry sector. As a training provider we are also working with all relevant governing bodies to stay at the forefront of changes by Skills England. GEM hold direct funding and are able to support with a range of upskilling and staff development programmes to aid your workforce development.

I would welcome the opportunity to discuss the changing landscape with you and outline the support and programmes we offer that can enhance your People plans.

https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

https://www.gov.uk/government/consultations/invest-2035-the-uks-modern-industrial-strategy

https://kpmg.com/uk/en/home/media/press-releases/2024/11/uk-reports-on-jobs.html

https://www.ft.com/content/a450f1f2-c96c-4609-baee-fed1354f3da1

https://www.gov.uk/government/topical-events/autumn-budget-2024

https://commonslibrary.parliament.uk/research-briefings/cbp-10109/